Candles – beyond their aesthetic, therapeutic, and mood-setting benefits – have also cemented their status in homes as one of the ultimate status symbols – but does this hold true in Asia?

In home decor, candles are no longer just for specific seasons like Christmas – they’ve become essential items year-round and coveted symbols of style and luxury. This transformation has been especially noticeable during the pandemic, as people have spent more time at home, making their living spaces even more important. But this trend isn’t temporary; it’s a significant movement that’s gaining momentum worldwide, with Southeast Asia fully embracing it.

According to Statistica, the revenue in the candles market segment in Southeast Asia reached US$0.40 billion in 2024. Projections indicate a steady annual growth rate of 4.11% from 2024 to 2028 (CAGR 2024-2028). By comparison, the United States continues to lead globally, generating the highest revenue in the candles market segment, amounting to US$2,199 million in 2024. On a per-person basis, Southeast Asia generates US$0.57 in revenue per person in 2024. The demand for traditional handmade candles is witnessing an uptick in Southeast Asia as consumers increasingly value unique cultural experiences.

Diptyque, a globally renowned candle brand, highlights that candles are not only cherished for moments of “me time” but also serve as a means to infuse personal flair into spaces – an aspect that particularly resonates with Generation Z.

“We’ve noticed that people are seeking out unique scents as a kind of personal branding and a way to bring their own personality into their living spaces,” explains Julien de Mestier, General Manager of Diptyque Hong Kong and Macau, “As such, the growing demand for home fragrance products has contributed to a surge of candle brands on the market, especially homemade and boutique brands.”

So just how strong is the market demand from Asia and which brands have been taking note?

The Asian pull

According to several well-known international candle brands, there has been a robust demand emanating from Asia.

Baobab Collection, a Belgian brand which draws inspiration from African lands and has been on the market since 2002, believes that Asia is an emerging market for candles. “We see some changes, especially with Japanese customers who are now buying our candles in EUROPE and complain about the fact we are not selling the candles on their market,” says Corinne Bensahel, Baobab Collection’s Senior Vice President in Marketing and Development.

Similarly with The White Company, a British luxury lifestyle homeware company, Asia is quickly becoming a targeted audience. “Candles and all home fragrance sales have increased,” explains The White Company’s chief creative officer Mark Winstanley, “I think over the last few years our homes have become more important than ever before. The world has changed and working from home has become quite a part of normal life, it actually means our homes have to work harder.” Winstanley adds that the past five years, there has been an increase overall for more candle products.

With the global home fragrance market projected to reach US$19.4 billion by 2030, boasting a Compound Annual Growth Rate (CAGR) of 8.6%, it stands as one of the fastest-growing categories. Candles play a significant role in this expansion. L:A BRUKET, a natural and organic skincare brand hailing from the west coast of Sweden, observes that the pandemic has prompted consumers to shift their focus from external environments to their interiors. This shift emphasises introspection and a burgeoning interest in personal well-being. “Candles are a great combination to answer all those needs, making the search and sales explode in Asia, especially in China where 51% of consumers said they try to use candles to calm themselves. Post-pandemic, the habit remained, allowing the category to continue to grow,” says the rep.

Similar to Winstanley and L:A BRUKET, Vivian Wong from Officine Universelle Buly concurs that the COVID-19 pandemic expedited a shift in people’s perceptions towards enjoying life. With working from home becoming the norm, the desire for home fragrance is not merely incidental but indicative of a broader trend towards enhancing domestic environments. “The second reason is the realisation of ‘joie de vivre’ in the sense of an ambience scent which fits our living space. The sophistication and intellectual progression of Asian customers have brought them to appreciate and explore more on the scent for their living spaces,” she adds. Under the ownership of LVMH, Officine Universelle Buly 1803 is a revered French beauty brand with a centuries-old legacy, drawing in numerous scent enthusiasts as a premier choice.

Besides home enjoyment, brands have also noticed an increase in demand for candles based on the customer desire for more natural, authentic products in their home. Eym, which uses 100% natural ingredients and has the option for refillable candles, stresses the importance of non-toxic fragrances. Eym’s founder Poppy Wall says, “I think from our perspective, as a 100% natural brand, we are just so happy to see the awareness spreading about using non-toxic fragrances.”

Australia-based Addition Studio concurs. “I believe the heightened interest can be attributed to the perception of Australia as a premier producer of high-quality natural ingredients and finished products,” says the brand’s founder, Ryan Hanrahan, “Asian consumers increasingly seek out candles that offer not just ambiance but also a sensory experience.”

Although international candle brands currently hold a significant market share in Asia, there’s a growing emergence of local brands throughout the region, attracting consumers who seek to support homegrown businesses utilising homemade ingredients – or even get involved in the process.

In Hong Kong, for example, BeCandle’s founder Xavier Yin Tsang saw an uptick in consumers even wanting to make their own candles during the lockdown period of the Covid-19 pandemic. “During the lockdown period, people became increasingly interested in exploring craft experiences they could learn, such as candlemaking,” he shared.

Wen Zhang, from Press Only and The Breakfast Press, a PR firm representing numerous candle clients, has observed Asia’s emergence as a hub for candle products. “As a candle distributor as well, we’ve recognised that there’s been a stronger demand for friendly, fun and affordable candles that are relatable,” explains Zhang, “Consumers in Asia have also grown relatively more mature to their awareness of candles and grown increasingly price sensitive.”

The Asian customer profile

Being in Asia however, means the customers’ preferences can differ greatly from the tastes of the west. Baobab’s Bensahel explains how Asian consumers tend to go for more aromatic fragrances or light floral scents, as opposed to European customers who tend to have a wider palette. “It seems Asians are more sensitive to strong fragrances like woody perfume identities or spicy identities,” she adds.

In comparison, Diptyque’s De Mestier says that floral and woody scents are some of the most popular among our customers in Hong Kong and Macau, with Baies (berries) and Rose being some of their best-sellers in the region. “Asian consumers tend to embrace seasonal and festive scents that align with the region’s holidays and traditions,” he adds, referring to seasonal drops such as the Citrouille (Pumpkin) scented candle in October, and the Fleur de Cerisier (Cherry Blossom) scented candle in February. Limited-edition scents such as Sapin, Coton or Delice during the year-end Holidays or Citronelle during Summer are also popular “rendez-vous” for their customers, he adds.

In contrast to brands like Bath & Body Works in the US, which excel in crafting dessert-inspired fragrances evoking themes of cookies, cakes, and strawberries, the Asian consumer often favours more subdued and delicate scents, along with functional aromas designed to aid daily needs such as sleep. “In Asia our Mellow and Rest candles seem to do particularly well, these scents are created with a huge relaxation and sleep focus,” shares Eym’s Poppy Wall.

Standing out

With the growing number of candle brands saturating the market, older heritage brands still maintain dominance. In such a competitive landscape, what distinguishes a brand and enables it to stand out?

To captivate the Asian market, brands must grasp the pulse of their diverse customer base. Quality craftsmanship, authentic storytelling, and sustainability are paramount. Moreover, leveraging digital platforms effectively is key. Standing out demands a deep understanding of culture, a commitment to sustainability, and savvy digital engagement.

And of course, it’s about having an aesthetically-pleasing yet functional design. “For us, it’s about quality of burning, the fact that we are more than a perfume, we are also a statement, an object of decoration,” explains Baobab’s Bensahel, “Then, when you are addicted to a scent you want to have it everyday, it becomes a part of your well being. A candle makes you feel good at home.”

It’s also about having a mix of options for the diverse consumer. “A combination of taller candlesticks with lower tealight holders always looks beautiful on dining and occasional tables, mantelpieces and kitchen islands,” says The White Company’s Winstanley, “And using candle holders in different materials is something I love to do. Clear glass and mercury work so well together, but equally for a more natural look seagrass and rustic vessels look great too.”

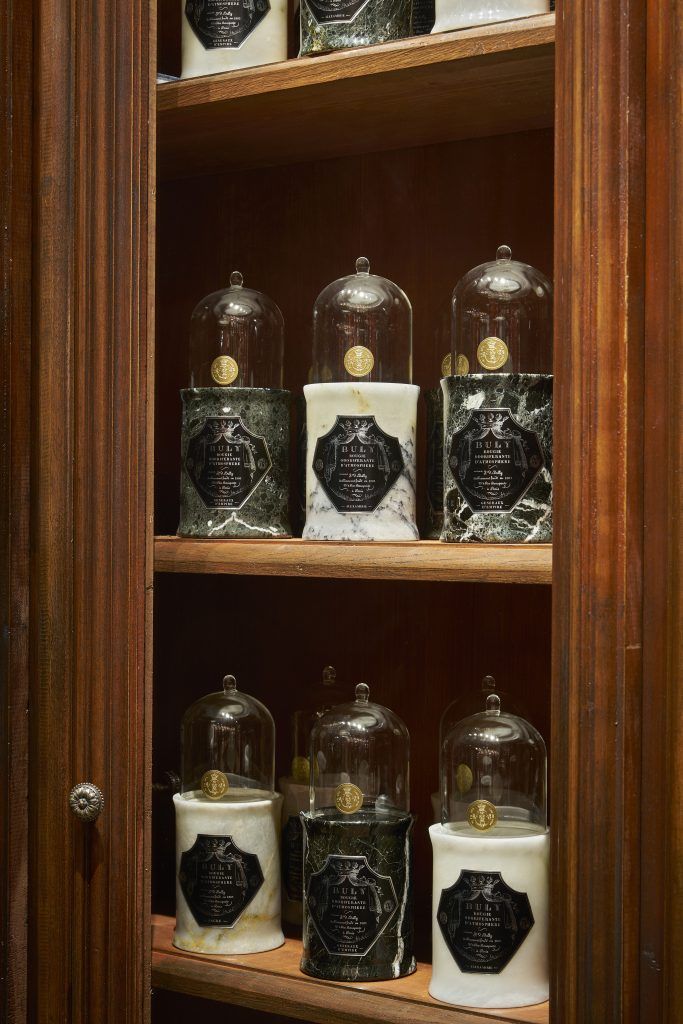

Vivian Wong from Officine Universelle Buly underscores the significance of offering standout, distinctive products. Since its introduction in 2014, the brand has cultivated a signature aesthetic, epitomised by handcrafted marble jars and glass bells, which have become iconic. These containers house eight exquisite fragrance blends inspired by French history, religious rituals, and exotic destinations. Wong highlights the brand’s commitment to uniqueness, with each 250g retail candle encased in marble exhibiting natural variations, promoting reuse as a vase or container. In addition to enhancing the scent experience, the brand introduced a thermal desk lamp in 2022, ingeniously diffusing candle scents to complement its aesthetic and cater to those seeking alternative ways to enjoy fragrances.

With Diptyque, they launched their first refillable candles last year, Les Mondes de Diptyque, which have already become a fan favourite. ”Each of the 5 glass monolith candles is carefully crafted to transport individuals to a different garden in the world, allowing them to embark on a sensory journey without leaving their home,” says De Mestier.

Wen Zhang of Press Only highlights that in Asia, consumers seek candles and home pieces that add value to their busy lifestyles, reflecting their personal values. “In my personal opinion the brands that were only out to grab attention but with poor quality will not survive as the consumer is mature enough to seek a good quality candle,” she says.

Beyond their pleasing aesthetics and delightful scents, candles offer therapeutic benefits. Certain fragrances promote mental clarity, while others induce relaxation, making them ideal for pre-bedtime rituals. In Sweden, where L:A BRUKET is from, lighting a candle is a common practice throughout the day. “Sometimes we even light them for breakfast, since the winter days can be quite dark,” explains the rep, adding how “the flick of a candle brings peace, light, and poetry.”

“We harness therapeutic properties of natural ingredients so that our candles offer not just aroma but also the potential for relaxation, healing, or uplifting moments,” shares Addition Studio’s Hanrahan, “I also love the soft, flickering light emitted by candles during the night. It can make any space cosy.”

Candles as a status symbol

As high fashion brands increasingly delve into the candle market, it’s a logical progression given the longstanding association between fashion and fragrance.

Brands like Gucci, Celine, Dior, Loewe and Versace are all getting into the candle game. Some are even collaborating with renowned candle brands – like Jo Malone London x Richard Quinn Tuberose Angelica ceramic scented candle and Cire Trudon X Giambattista Valli Rose Poivre Candle, making them the ultimate fashion-fragrance flex.

“We see more high fashion brands are eager to develop a home fragrance collection which features scented candles with bespoke scent creations,” says Officine Universelle Buly’s Vivian Wong, “There is still much space for creativity in scent craftsmanship and in particular, the design and craftsmanship of the candle case.”

“A lot of fashion and accessory brands have started to dabble in the market leveraging candles as a stepping stone for products into broader lifestyle categories,” adds Addition Studio’s Hanrahan. But what does this mean for the legacy brands, and the boutique ones which have grown a cult following since their inception?

Luxury brands typically command higher prices than many candle brands, making it unlikely for them to replace the latter. However, they remain highly sought after by discerning high-fashion shoppers.

“We try not to look at what everyone else is doing too much and really stick to our guns on creating beautiful, natural, mood-boosting fragrances,” says Eym’s Poppy Wall.